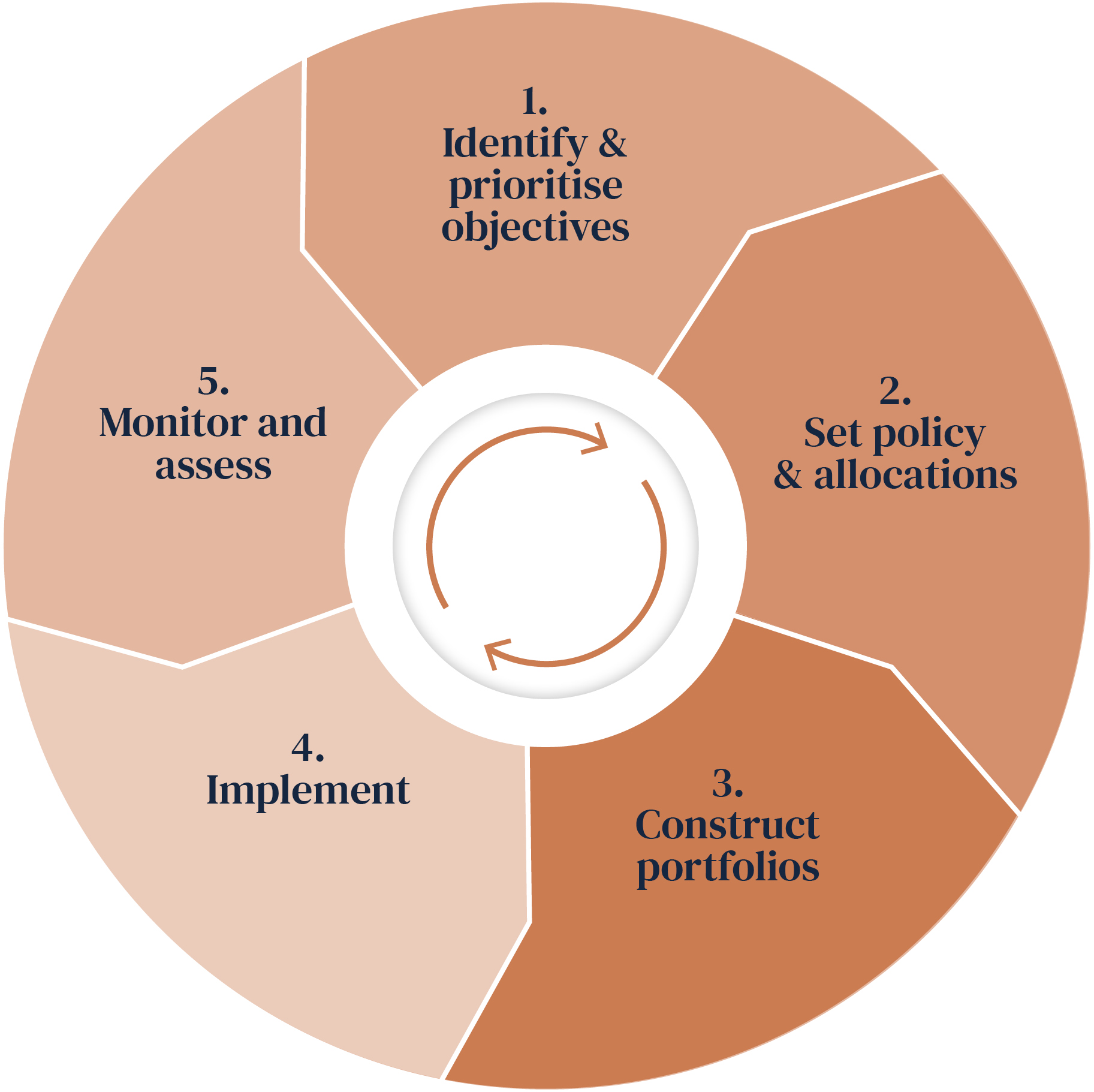

Our investment approach is our key differentiator. Through advanced portfolio construction and institutional-grade risk management, we ensure our clients’ portfolios are aligned to individual values, resilient, and adaptable.

We have designed an investment philosophy that preserves wealth through a wide range of economic conditions. Our approach aims to achieve:

- True diversification – a statistically robust level of diversification designed to handle a wide range of economic conditions and market shocks.

- Resilience and stability – better volatility and drawdown management to minimise the near-term impact on compounding, improving the consistency of performance.

- Better decisions –robust diversification, low volatility, and muted drawdown profile focused on long-term outcomes and reduces the need to make decisions under stress.